UC Newsroom

If you’ve been admitted to a UC campus (congrats!), you might have some questions about financial aid. We have answers. Here are the top 5 most common questions we hear from students.

1. When will I receive a financial aid offer?

If you have completed a FAFSA or California Dream Act Application (CADAA), you can expect to receive financial aid offers along the following timelines:*

-

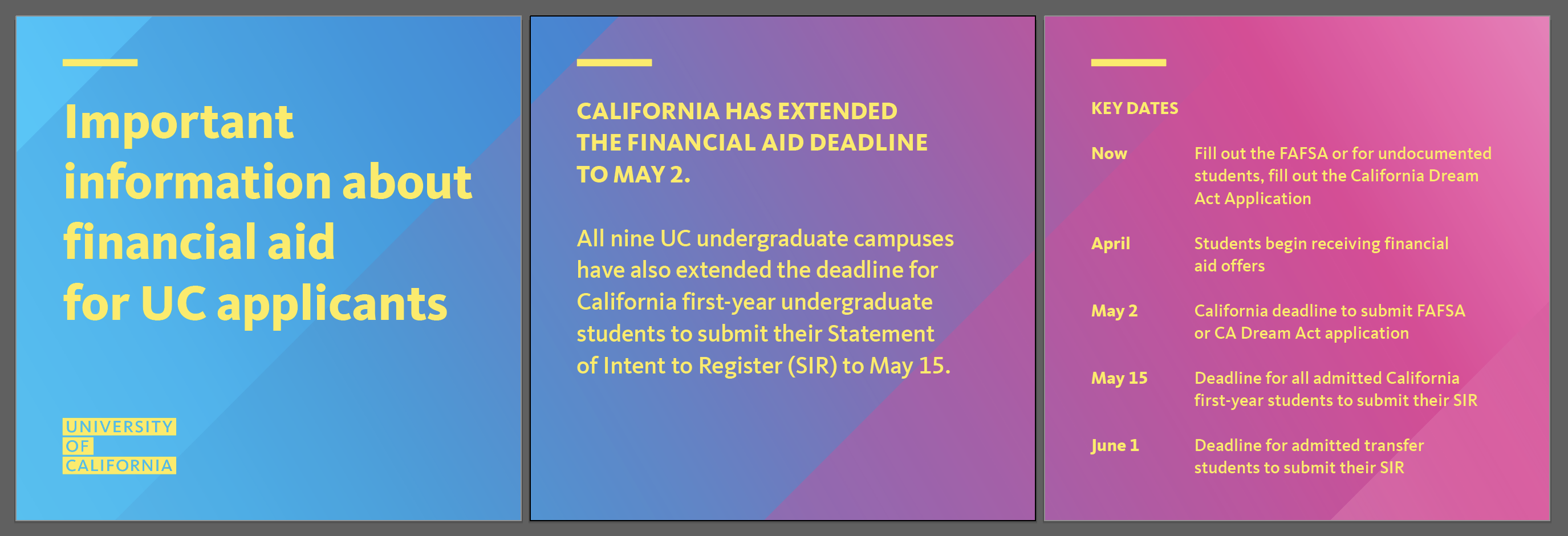

First-year admits for fall 2024 will get preliminary offers in April.

-

Transfer admits for fall 2024 will get preliminary offers in May.

-

Continuing UC students can expect offers in June or July.

We encourage you to complete your FAFSA or CADAA as soon as possible so that we can process your offer before your enrollment decision deadline (May 15 for first-year students or June 1 for transfer students).

*Please note that these estimated timelines are based on the Department of Education's anticipated delivery of financial aid information to schools.

2. One of my parents doesn’t have a Social Security number, so I am unable to complete the FAFSA. I’m worried I will not be able to complete the FAFSA by the May 2 priority deadline. What should I do?

We know there’s a glitch with the FAFSA right now for some families. If you’re in this situation, we encourage you to use the workaround created by the Department of Education:

How to submit the 2024-25 FAFSA form if your contributor doesn’t have an SSN

Stay informed: California residents can also sign up for the California Student Aid Commission’s Non-SSN Contributor Email List for updates on fixes to this FAFSA issue and alternative solutions.

Financial aid deadline: The state of California recently extended its financial aid application deadline to May 2. UC campuses are committed to making sure students have sufficient time to complete the FAFSA and will be in touch with applicants as guidance evolves.

3. I noticed that my Student Aid Index is higher than my Expected Family Contribution was last year. Does this mean I’ll get less aid this year?

The way financial aid eligibility is calculated has changed. This means your Student Aid Index (SAI) this year might be different from your Expected Family Contribution (EFC) in the past. There is no numerical correlation between the SAI and the EFC. How much aid you get will depend on your individual circumstances.

4. Who do I invite to be a contributor to my FAFSA?

It depends on whether you are considered dependent or independent by the FAFSA. If you are a dependent of your parents, the answer is different based on your parents’ tax filing status:

-

Married filing jointly: Invite only ONE parent. Their tax info will cover both when they share it with the FAFSA.

-

Married filing separately or head of household: Invite BOTH parents.

-

Divorced parent with remarried spouse: If your main financial support comes from a remarried parent, include their spouse's tax info too. Invite them as a contributor if they filed separately.

Students who are married and file their federal taxes separately from their spouse will need to invite their spouse as a contributor.

Remember to use 2022 tax information!

5. Will information about me and my parents or spouse be shared with Homeland Security?

Your information will not be used for immigration enforcement. The Department of Education (ED) takes protecting your information seriously. They follow strict rules to handle your FAFSA data responsibly. They’ll only share your information (not your parents’ or spouse’s) and only for the purposes below.

ED needs your personal information in order to:

-

Verify that you’re a real person. This helps prevent fraud.

-

Check if you qualify for aid.

-

Prevent fraud. Sharing some info with other government agencies helps prevent fraud. For example, ED might check your Social Security number with the Social Security Administration to make sure you’re eligible for aid and haven’t passed away (only for applicants, not contributors).

Who gets your information and why:

-

Social Security Administration: To verify your identity and tax information.

-

U.S. Department of Homeland Security: To confirm your citizenship for federal student aid eligibility (only for applicants, not contributors).

Important to know:

-

Any government agency receiving your information from ED can only use it for these specific reasons, not for immigration or law enforcement.

-

If you don’t have a Social Security number and need go through an identity verification process, the company that does the check (TransUnion) can only use your information to verify your identity — they can’t keep or share it with anyone else.

To learn more about how your information is used and shared, check out the Department of Education’s privacy statements.